CasinoRank Reveales Which Game Studios Released the Most New Casino Titles This Year?

Recommended casinos

Every year in the iGaming industry comes with surprises, big launches, new mechanics, and—perhaps more importantly—a steady stream of fresh content from game providers. But 2025 stood out for one major reason: the sheer volume of new game releases flooding online casinos worldwide.

Some suppliers pushed harder than ever, releasing hundreds of titles across multiple markets—while others focused on strategic local rollouts to gain visibility with specific operators. As casinos continue to expand their lobbies, volume has quietly become one of the most important metrics for supplier competitiveness. At CasinoRank, we analyzed site-by-site data from 2025 to answer a simple yet revealing question: Which game studios actually released the most new games to online casinos this year? The results paint a clear picture of who dominated content supply in 2025—and why. Let’s break it down.

How We Looked at the Data

To understand which studios contributed the most new casino games this year, we examined: new games added per site, which suppliers appeared first, the number of titles deployed by each supplier, and where and when these releases appeared.

In simpler terms: We tracked who released the most, where those games landed, and how early they appeared across different markets.

This gives us a detailed, real-world view of supplier output—not just how many games were announced on paper, but how many were actually integrated into casino catalogs.

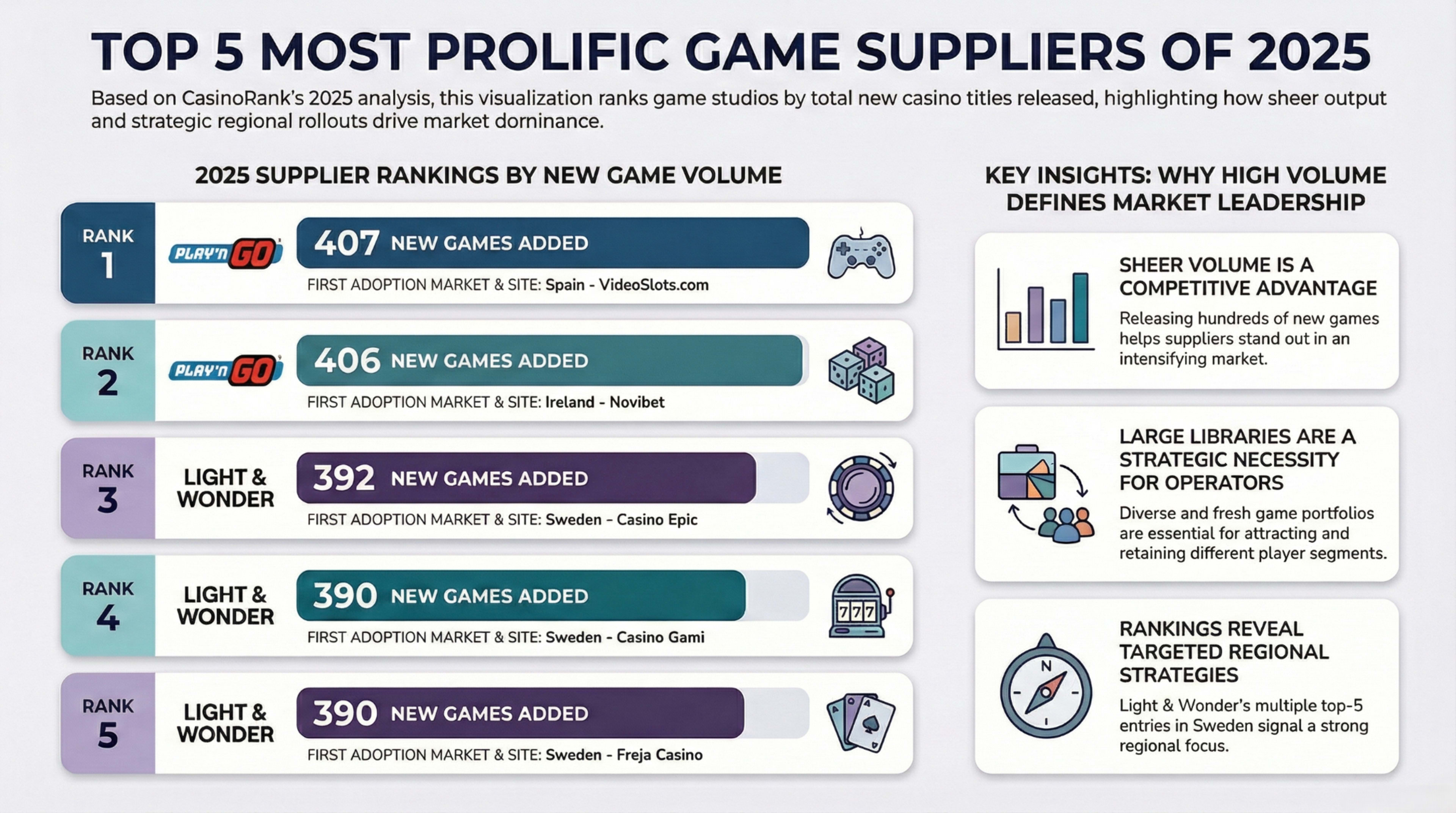

Top 5 Game Suppliers of 2025 (Ranked by Number of New Titles Added)

Let’s jump straight into the numbers, because they tell a fascinating story.

1. Play’n GO – 407 New Games

First Seen: VideoSlots.com (Spain) – January 31, 2025

Play’n GO takes the #1 spot with a massive 407 new game additions across operators—making them the most prolific supplier of 2025.

Seeing Play’n GO appear first on VideoSlots.com in Spain also fits the pattern we often see: Spain tends to adopt new releases quickly, especially from major studios. Play’n GO’s early rollout helped seal its position before most other suppliers hit their stride.

2. Play’n GO – 406 New Games

First Seen: Novibet (Ireland) – April 29, 2025

Unusually, Play’n GO appears in both the #1 and #2 spots. Why? Because this ranking looks at site-specific adoption. So on Novibet in Ireland, the supplier added 406 titles, nearly replicating its Spanish output.

This double appearance highlights two things: Play’n GO’s cross-market consistency and strong demand for its portfolio across different regulated markets. Ireland’s Novibet site was one of the quickest to load up nearly the entire Play’n GO library, giving the supplier an early-year push in Western Europe.

3. Light & Wonder – 392 New Games

First Seen: Casino Epic (Sweden) – February 5, 2025

Light & Wonder takes the #3 spot with 392 new titles, landing heavily in Sweden early in the year.

Casino Epic was one of the first Swedish operators to add the new content set, marking the beginning of what would become a notably aggressive rollout in this region.

4. Light & Wonder – 390 New Games

First Seen: Casino Gami (Sweden) – February 5, 2025

Another Swedish operator, another major Light & Wonder update. This second appearance confirms that:

Sweden was a key early-year launch market for Light & Wonder. Operators in this region prioritize large content drops. Light & Wonder executed a synchronized rollout strategy.

5. Light & Wonder – 390 New Games

First Seen: Freja Casino (Sweden) – February 5, 2025

Rounding out the top five is yet another Light & Wonder integration, also in Sweden, also showing 390 game additions.

This triple appearance paints Sweden as one of the most supplier-hungry markets of 2025—especially for major studios.

Why Are Play’n GO and Light & Wonder Dominating?

Two suppliers appear across all five top slots. Let’s talk about why.

1. Volume is now a competitive advantage

The top studios aren’t just making a handful of new titles—they’re releasing hundreds. This level of output allows them to:

Reach more operators. Cover more regional markets. Fill multiple content niches (classic, cluster, Megaways, bonus buy, etc.). Keep casino lobbies constantly fresh. For operators battling for player attention, more variety = more retention.

2. Distribution networks matter

Both Play’n GO and Light & Wonder have robust global distribution pipelines. This means:

Their games reach regulated markets faster. Their titles pass compliance checks more efficiently. They can roll out multiple releases on multiple sites simultaneously. This is especially clear in Sweden, where Light & Wonder executed a triple rollout on the same day.

3. Operators trust “safe” suppliers

Casinos rarely hesitate to add known suppliers. When a new Play’n GO or Light & Wonder game drops, operators know:

It will perform. It will be stable. It will already have international recognition. Players will immediately try it. That trust accelerates adoption.

The Role of Regional Markets in Supplier Growth

One of the most interesting elements of the ranking is how different regions behaved in 2025.

Spain

The Spanish market often leads in early adoption for top suppliers, especially with a heavy emphasis on mobile play. Play’n GO landing there first is no surprise, given their mobile-first design philosophy.

Ireland

Ireland tends to favor large, diverse game libraries. Novibet's addition of 406 Play’n GO titles reinforces that Irish players gravitate toward well-known, popular slot mechanics.

Sweden

Here’s the standout: Three of the top five entries in the entire dataset came from Sweden.

The Swedish market is extremely competitive. Operators want large catalogs because players in Sweden expect a high variety of titles and frequent new releases. Light & Wonder’s triple rollout suggests a strategy optimized for: Regional saturation, Fast distribution, and High visibility across Swedish operators. 2025 made it clear that Sweden is one of Europe’s most content-hungry jurisdictions.

More Than Just Numbers — What These Rankings Really Mean

Let’s move beyond the counts and talk about what this ranking actually signals for the industry.

1. The “content race” is accelerating

In 2025, suppliers aren’t just releasing games—they’re racing to out-release each other. This arms race pushes for faster development cycles, more experimental mechanics, higher production quality, and more niche themes. Studios know that operators choose suppliers who can deliver both quantity and consistency.

2. Operators prioritize portfolio diversity

With hundreds of new games added every year, Casinos update their lobbies more frequently. They test more mechanics to find early-performing titles. They use volume to refine player segmentation. Suppliers that deliver more content give operators more room to experiment.

3. Smaller suppliers now face a steeper hill

When two studios are adding close to 400 games per operator per year, mid-tier suppliers need to either increase output, specialize in unique mechanics and themes, or the days when one or two great games could carry a studio are fading. Volume + visibility is the new winning formula.

What to Expect in 2026

Based on what we observed in 2025, here’s what the market is likely to see next year.

More aggressive content release schedules

Studios will push faster, more frequent drops to keep up with industry leaders.

Regional-first rollout strategies

Suppliers may focus on specific markets where they can quickly dominate—similar to Light & Wonder’s Sweden strategy.

More branded slots and cross-media collaborations

To stand out among hundreds of releases, studios may turn to: TV show themes, music partnerships, movie tie-ins, and cultural collaborations.

Fast-track licensing for emerging markets

As more regions regulate online gaming, suppliers will race to secure early approval to gain strategic advantages.

Mid-tier suppliers moving into niche mechanics.

Crash games, instant wins, ultra-high-RTP classics, and hybrid live/slot formats are likely areas of focus.

Final Thoughts: 2025 Was the Year of High-Volume Competition

If one lesson comes out of this data, it’s this: 2025 proved that “number of games released” is now a defining metric in the iGaming landscape. Play’n GO and Light & Wonder clearly understood the assignment, dominating content supply across Spain, Ireland, and Sweden. Their aggressive rollout strategies, immense volume, and global distribution capabilities put them at the top of the charts—far ahead of mid-tier competitors.

For casinos, this means larger game libraries than ever before. For players, it means constant variety and an endless stream of new experiences. For suppliers, it means competition will only intensify from here. 2026 is shaping up to be even more competitive—and we’ll be watching every step of that race.